American Democracy Is Not A Charity Case

Facebook CEO Mark Zuckerberg, America’s fourth-richest person, finally admitted that no one deserves to accumulate as much wealth as he has.

But hey, he says, at least he plans to give a lot of his $69.6 billion net worth to charity.

That’s nice. But it’s not enough considering the threat of concentrated wealth to the American ideal.

America’s very democracy is dying because billionaires like Zuckerberg amass ever more wealth—and thus ever more political power—while everyone else struggles with less. Less money. But, just as importantly, less clout in government.

Philanthropy is fine. But to preserve a functioning democracy, everyone, including billionaires, must pay a fair share of taxes so that America has the money it desperately needs to address shared priorities, reinvigorate the middle class and repair the social fabric torn by income inequality. And we need real limits on campaign contributions to stop the nation’s slide from democracy, where many have a voice, to oligarchy, where only the rich are heard.

The rich don’t pay anything like their proportionate share of taxes right now. Not even close.

In fact, a new study shows that the super-rich pay a lower rate than working Americans thanks to the Republicans’ 2017 tax giveaway.

Last year, the nation’s 400 richest families paid an average effective tax rate of 23 percent, compared to the 24.2 percent paid by the bottom half of U.S. households. It turns out hotel queen Leona Helmsley was right all those years ago when she said only the little people pay taxes.

In 1960, the tax rate for America’s 400 richest families was 56 percent. By 1980, it had dropped to 47 percent. As the tax rate for those families fell between 1960 and last year, the middle class shrank, income inequality rose to a 50-year high and the rich consolidated political power through unchecked political contributions.

It’s a vicious cycle. Rich people use their money to hijack the political process and pass laws, such as the 2017 tax windfall for the rich, that give them still more money to push their agenda at the expense of middle-class priorities like stronger Social Security and Medicare.

The few are ruling the many. Make no mistake, American democracy is under attack from within.

During a company town hall meeting, a Facebook employee asked Zuckerberg about the morality of being a billionaire. Zuckerberg said no one “deserves” to accumulate the vast wealth that he has, but he quickly pointed out that he gives much of it away.

Better that rich people donate some of their money than blow it all on waterfront mansions, mega-yachts and sports cars for themselves. And philanthropy can fund important research and social-service projects.

But it’s dangerous for a small group of rich people to decide which issues get attention and buckets of cash. This just enhances their status and power.

In a functioning democracy, everyone gets a voice in these kinds of decisions through proper representation and taxation. Taxes are an obligation for the common welfare. Everyone contributes a fair share so that the pool is big enough for the people—through their duly elected representatives—to address shared priorities, from national defense to public schools.

For example, with funds from equitable taxation of all people – rich and not rich – Americans might decide to overhaul their roads, bridges, tunnels, locks and dams. Their condition right now is a national disgrace. A major tax investment in infrastructure would generate family-sustaining jobs—something that would pump up the decimated middle class—and keep commerce flowing.

Some of the additional tax money also could be spent on programs to help Americans struggling to pay for college and health care. Or it might be used to provide food stamps for the poor.

Right now, to save $4.5 billion, the Trump administration wants to kick 8,000 people off of food stamps and reduce benefits to thousands more. Yes, Trump intends to short-change the poorest of the poor after helping the super-rich dodge their tax obligations. But that’s what happens when the rich control the political process.

America’s political system, ideally, is based on a one person, one vote principle. That means each voter possesses the same political clout as every other.

But Americans don’t have an equal voice. And they will never get a just tax policy as long as the rich can buy whatever political policy they want with unchecked campaign contributions and loads of lobbyists. The U.S. Supreme Court gave the rich this gift – the power to spend unlimited amounts on campaign ads and use corporations to inject unlimited dark money into politics. The rich have used piles of money to muffle individuals, even large groups of individuals.

The relationship is transactional. The rich give Republican politicians the money they need to win elections. And then Republicans pass laws benefitting their benefactors and block laws for the 99 percent.

Just look at Senate Majority Leader Mitch McConnell’s opposition to a hike in the minimum wage.

The House this past summer passed a bill to increase the minimum wage to $15 an hour, up from the current poverty-level wage of $7.25 an hour. It would be the first increase since 2009. It’s urgently needed to help counter decades of general wage stagnation for American workers.

Kentucky, McConnell’s home state, had the nation’s sixth-highest poverty rate – 16.9 percent – last year, and lots of Kentuckians would benefit from a minimum wage bump. But McConnell won’t bring the bill to the floor. Wealthy employers told him they don’t want it.

Similarly, the power of the 1 percent is the reason that far fewer workers will receive overtime pay than deserve it. The Obama administration proposed extending overtime eligibility to all workers making $47,476 a year or less. The cut off had been $23,660. But wealthy business groups protested the Obama number, won a court decision that the Republican Trump administration declined to appeal, and now Trump’s Labor Department has reduced the overtime number to $35,568. That means 8 million fewer workers will benefit. Great for wealthy business owners who don’t have to pay. Not so great for those who do the work.

Zuckerberg knows lack of equal representation is a problem. Last year, he gave $200 million in Facebook stock to the Silicon Valley Community Foundation, which asserts: “A healthy democracy is dependent on all community members influencing public policy decisions that affect their lives and neighborhoods.”

Zuckerberg’s charity isn’t going to make that true nationwide, however. Americans must change the system corrupted by big money.

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.

Related Blogs

Ready to make a difference?

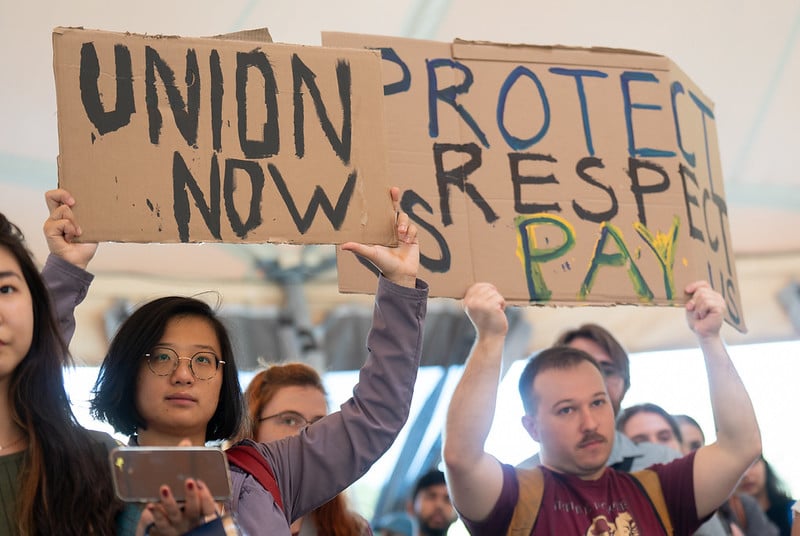

Are you and your coworkers ready to negotiate together for bigger paychecks, stronger benefits and better lives?