Fat Cat Tuesday: A Commemoration of CEO Excess

Fat Tuesday is Mardi Gras, a day of revelry, gluttony, intoxication and showers of shiny plastic beads. It is the party to end all parties because it’s followed by Ash Wednesday, when Lenten sacrifices commence.

Fat Cat Tuesday is the day – Jan. 2, 2018 – on which the boards of directors of America’s biggest corporations handed their CEOs more money than those same CEOs would deign to pay their workers for an entire year of labor, 260 days.

It was a day of revelry, gluttony and private jets for CEOs and worthless shiny plastic beads for workers.

The occasion is commemorated in Britain as well. There, though, it took CEOs three days to accrue more compensation than the total annual wages of the typical worker.

That’s because American CEO pay takes the cake – and we’re not talking Mardi Gras King Cake containing a tiny plastic baby Jesus figure because no Son of God would be associated with U.S. CEOs’ sinfully gluttonous pay packages.

The average pay of Fortune 500 CEOs – a gobsmacking $14.3 million – is four times that of top executives at comparable sized corporations worldwide, according to a study by Bloomberg analysts.

And it’s 265 times what the median U.S. worker earns – enabling U.S. CEOs to rake in more cash for one day at the office than the median worker gets for laboring an entire year.

Here’s how it breaks down: The typical CEO at a Fortune 500 corporation got $53,846 for showing up at the office on Tuesday, Jan. 2, 2018. The median American received $44,668 for working the entire year of 2017.

For one day on the job, those fat cats were awarded $9,178 more than all the wages a typical American earned over an entire year. That $9,178 is one fifth of an average worker’s annual earnings.

Given that, it’s no surprise that America holds another dubious distinction: it’s the country with the most cavernous pay gorge between fat cats and typical workers.

It doesn’t have to be that way. In Norway, the top CEOs average $1.28 million in compensation, meaning they earn 20 times what that country’s typical worker does – not 265 times. And yet, somehow, Norwegians attract talented executives to run their companies.

Germany, a country respected worldwide for its success in manufacturing and exporting, manages to find executives willing to work for only 174 times the pay of the country’s average worker.

In addition, in America, workers who mess up get fired, but not CEOs.

Disney CEO Bob Iger is one of those CEOs living in paycheck fantasyland, taking home $37.7 million. He’s trying to buy 21st Century Fox Inc.’s entertainment assets for Disney. Even if he fails, he’ll get a $27 million bonus. That’s $27 million for a fiasco. It’s a guaranteed bonus of wonderland proportions. Golly gee willikers, Mickey!

Disney has $37.7 million sitting around to give Iger, but charged its theme park workers for costumes. That meant 16,339 Disney Park Donald Ducks and Buzz Lightyears earned less than the federal minimum wage of $7.25 an hour, a violation of federal law. The U.S. Labor Department ordered Disney to repay them $3.8 million.

Looks like Disney tried to get solid gold Mouseketeer ears for Iger out of the hides of its lowest-paid workers. Now that’s goofy.

Non-CEO American workers have been stuck with nothing but shiny plastic beads for decades as their wages stagnated. But the fat cats at the top got more no matter how badly they performed.

Take Goodyear’s CEO Richard J. Kramer. The company hasn’t lost money over the past several years, but its performance has been less than notable. Despite that, the board of directors, for which Kramer is chair, keeps bumping up his compensation. It rose from $17 million in 2012 to nearly $20 million in 2016.

Three extra million over four years. It would take the median worker 67 years to earn the $3 million that the board of directors handed Kramer for mediocre accomplishments.

U.S. Steel Corp. has struggled in recent years, cancelling a planned new headquarters building in Pittsburgh after suffering losses of $1.5 billion in 2015. That year, former CEO Mario Longhi’s compensation dropped 35 percent. Still, the board of directors paid the now-retired CEO $8.6 million for losing $1.5 billion. That takes some steel cojones.

As part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Securities and Exchange Commission issued rules requiring public corporations to begin reporting this year the ratio between the CEO’s compensation and the pay of its median worker.

That’s nice. Really. The more depressing information workers can get about pay grabs by their bosses the better.

More effective in actually dealing with the problem, however, is what the Labour Party in Britain is proposing. If elected to power there, Labour says it would tax excessive CEO pay and disqualify from bidding on government contracts all corporations with CEO-to-worker pay ratios of more than 20 to 1, which is the current pay ratio in Norway.

That’s what America needs so workers receive a fair share of the wealth that their labor creates – in other words, significantly more than shiny plastic beads.

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.

Related Blogs

Ready to make a difference?

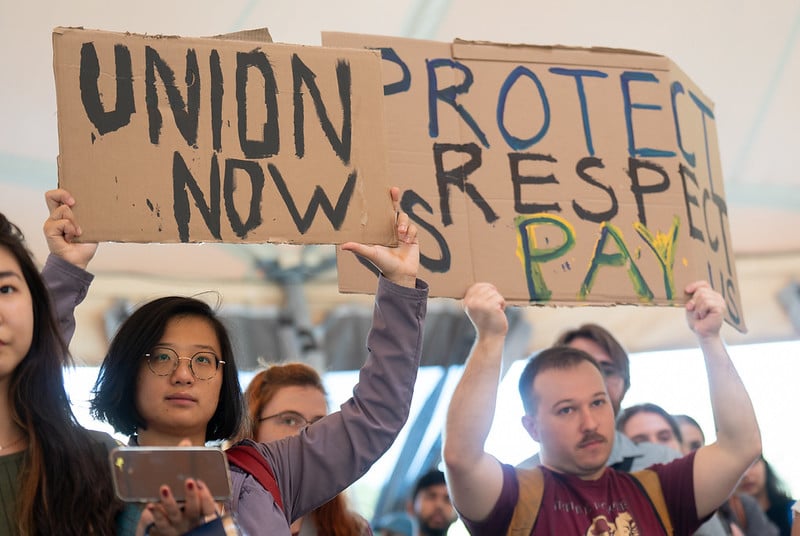

Are you and your coworkers ready to negotiate together for bigger paychecks, stronger benefits and better lives?