Extending Unemployment Benefits During The Recession Prevented 1.4 Million Foreclosures

They also found that the effect isn’t just a temporary forestalling of an inevitable foreclosure, but that it has a lasting impact on keeping people in their homes. “The effect seems to be long term,” they write, “as UI [unemployment insurance] benefits not only mitigate loan delinquency, but also reduce homeowner relocations and evictions.” Each additional $1,000 in benefits reduces the chance of an unemployed person’s mortgage going into default by 2.4 to 11 basis points. “We find that UI helps not only to postpone delinquency but also to keep laid off homeowners in their homes,” they conclude.

Extrapolating out from their findings, the authors estimate that the expansions in the unemployment benefits program during the recession prevented about 1.4 million foreclosures.

The research shows that bigger unemployment benefit checks have a positive effect for the people who receive them, proving that “[h]aving a source of income following job loss can enable households with credit obligations, such as mortgage payments, to continue making loan payments rather than defaulting,” as they write. The other option would have been that bigger benefits reduced the incentive for recipients to look for work, prolonging their unemployment spell and increasing the risk of default, but that’s not what their research shows.

Other research from the Government Accountability Office in 2010 comports with the new study, filling in the picture on the other side for people who don’t get unemployment benefits. Their poverty rate spiked and 40 percent had incomes below 200 percent of the poverty line. More than a third relied on government programs, while others relied on family members or savings.

The new research cuts against one argument in favor of letting the federal long-term unemployment benefits program lapse, as it did in December, which is that it would take away a cushion keeping people from job hunting and push more to get jobs. There’s other evidence that disproves that view. In Illinois, more than 80 percent of the long-term unemployed still had no income two months after being cut off from benefits.

And North Carolina has served as a testing ground, as it was cut off from the federal program months before it lapsed. There is no evidence that the cutoff helped the state’s labor force and in fact it is now experiencing the largest contraction in its workforce ever.

***

This has been reposted from Think Progress.

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.

Related Blogs

Ready to make a difference?

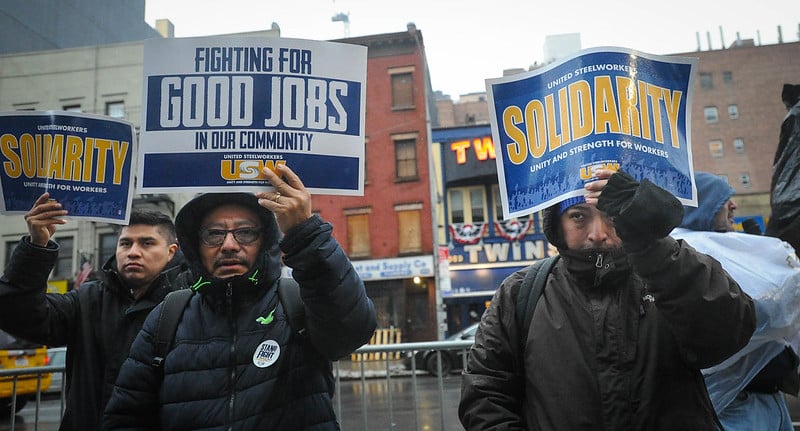

Are you and your coworkers ready to negotiate together for bigger paychecks, stronger benefits and better lives?