ExxonMobil’s Australian subsidiary—Esso Australia Pty Ltd (Esso)—is supporting its maintenance contractor’s move to slash wages up to 30 percent, cut benefits for 200 maintenance contractors, and impose a work schedule that would force offshore workers to spend more time away from home.

ExxonMobil’s Australian subsidiary—Esso Australia Pty Ltd (Esso)—is supporting its maintenance contractor’s move to slash wages up to 30 percent, cut benefits for 200 maintenance contractors, and impose a work schedule that would force offshore workers to spend more time away from home.

In response, the contractors went on strike at Esso’s Longford gas plant in June.

The three unions that represent the contractors at the plant and offshore oil and gas platform—Australian Manufacturing Workers Union (AMWU), Australian Workers’ Union (AWU) and Electrical Trades Union of Australia (ETU)—are waging a world-wide campaign and joining allies in pressuring ExxonMobil through exposure of its tax avoidance strategies.

The contractor, UGL, is flying in replacement workers (scabs) into Melbourne, Australia, and busing them to and from the Longford plant, while bypassing the nearby Gippsland community.

Legal Loophole

In February 2017, Esso awarded CIMIC Group company, UGL, a five-year maintenance contract to provide routine maintenance, shutdown and minor modification project services for Esso’s onshore oil and gas processing plants, including Longford, its offshore oil and gas producing platforms, and its crude oil, liquefied petroleum gas and gas pipelines.

Loopholes in Australia’s Fair Work Act allowed UGL to form a subsidiary company, MTCT Services Pty Ltd. (MTCT) on paper. In May 2017, UGL said if the maintenance workers wanted to keep their jobs they had to sign up with MTCT under an Enterprise Agreement (EA)—a collective bargaining contract—that slashed wages, benefits and degraded working conditions.

But, MTCT did not negotiate the EA with the affected maintenance workers. Instead, it negotiated and received approval from five MTCT employees in Western Australia who did not work at Esso’s oil and gas operations.

MTCT said it would employ the workers as casuals without permanent employee entitlements. Depending on a worker’s job classification, the company would cut pay up to 30 percent, and it would eliminate annual leave and other benefits such as sick leave and holidays.

“One of the worker’s main objections to UGL’s take-it-or-leave-it agreement is extending offshore shifts from weekly to fortnightly,” wrote a Gippsland ETU organizer, in a letter to the Gippsland Times.

“Not only does this make offshore work even harder physically, emotionally and psychologically on workers, but their families as well,” he added.

Fighting for Local Jobs

The unions are concerned the loss of local, high-paid maintenance jobs hurts the 1,550 businesses in the Gippsland region where workers spend their money. These businesses, the unions say, are losing $16 million every year in direct spending.

The unions are concerned the loss of local, high-paid maintenance jobs hurts the 1,550 businesses in the Gippsland region where workers spend their money. These businesses, the unions say, are losing $16 million every year in direct spending.

There also is concern that the community will see an exodus of skilled trades workers and their families, causing reductions in housing real estate values, lower tax revenue, and entrenchment of low-wage jobs and low-employment for future generations.

Esso is more concerned about being competitive.

In a letter to the Gippsland Times, a production operations manager for Esso Australia wrote: “One way we remain competitive is by periodically re-tendering our contracts. As supply-and-demand dynamics create rises and falls in costs, tendering ensures we receive quality service and materials at competitive market rates….We will continue to make the changes necessary to enable us to remain a competitor in this domestic gas market.”

Tax Cheater?

The Australian unions joined forces with Tax Justice Network Australia to pressure ExxonMobil. The group issued a report, “Is Exxon Paying A Fair Share Of Tax In Australia?”

The group’s analysis of Australian Tax Office (ATO) data for the 2014/15 tax year revealed ExxonMobil had nearly $8.5 billion in total income, but had zero taxable income and paid zero in tax.

Their research showed that it appears ExxonMobil lowers its tax burden by creating shell companies that give loans to Esso Australia.

A company in the Netherlands, ExxonMobil Australia Holdings B.V., owns the Australian operation and has no business other than holding the Australian company’s shares.

The Dutch company is 100% owned by ExxonMobil Asia Pacific Holding Limited, which was incorporated in the Bahamas in January 2000. The Tax Justice group counted at least 575 Exxon-related companies registered in the Bahamas, which is a known tax haven.

ExxonMobil denies that it uses the Bahamas to avoid taxes in other countries.

The report also found that it was highly likely that ExxonMobil used transfer pricing on crude and product purchases to shift profits out of Australia.

Click here to read the tax report.

What You Can Do To Help

Send messages of support to:

- alison.chalk@amwu.org.au

- andrew.dettmer@amwu.org.au

- anne.donnellan@amwu.org.au

- daniel.walton@nat.awu.net.au

- debra.bushell@nat.awu.net.au

- members@awu.net.au

- admin@etuaustralia.org.au

- eranga@etuaustralia.org.au.

Sign and share their petition.

Like the unions’ campaign Facebook page. You can also Tweet about @exxonmobil’s #UGLyplan.

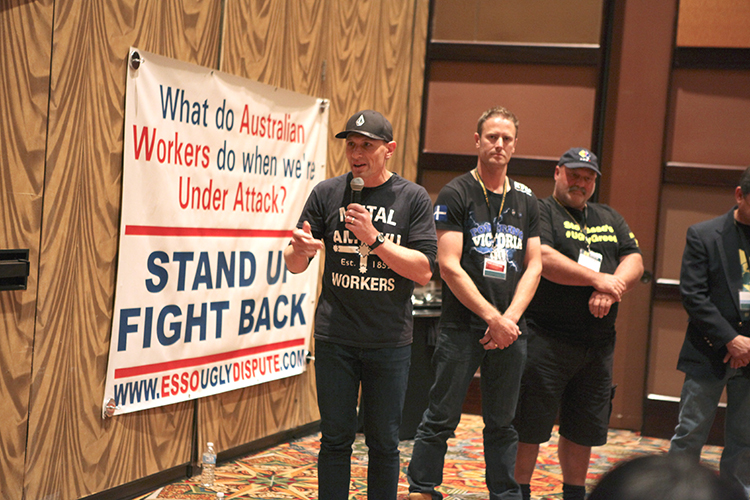

PHOTO: (L-R): Troy Corker, Australian Manufacturing Workers Union (AMWU), Steve Solomon, AMWU, and Dane Coleman, Electrical Trades Union (ETU).